Knight Frank Wealth Report Shows Australia Still Mixing It with the Best

Sydney sits at 11th on Knight Frank's index of luxury residential property, the PIRI 100, with Melbourne just behind at 12th.

Randwick in Sydney was identified in the Knight Frank Wealth Report as a potential growth spot for real estate prices.

Knight Frank’s Wealth Report 2017 shows that Australasia was the strongest-performing region for luxury house price growth in 2016, with its luxury home price index climbing 11.4 per cent over the year.

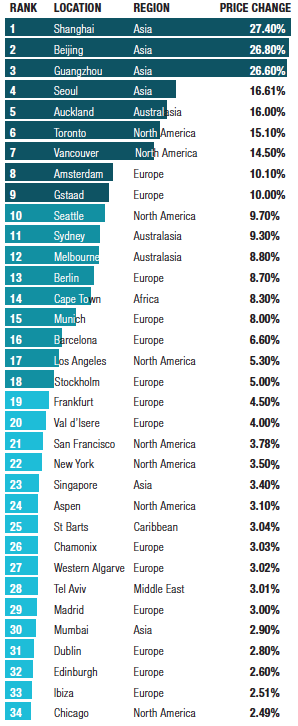

Knight Frank’s Prime International Residential Index (PIRI 100) index tracks the value of luxury homes in 100 cities around the world.

The top performers for 2016 were Shanghai (where luxury property prices rocketed 27.4 per cent higher over the year), Beijing (26.7 per cent), and Guangzhou (26.6 per cent), according to the index.

While Chinese cities outpaced other markets by a significant margin in the PIRI 100 index, cooling measures introduced in China are already having the desired effect of slowing the pace of property price growth.

Sydney and Melbourne came in at 11th and 12th respectively on the PIRI 100 index, recording growth of 9.3 per cent and 8.8 per cent in 2016.

Knight Frank’s Director, Residential Research, Australia, Michelle Ciesielski said, “In Sydney and Melbourne over the past 24 months, demand for prime property continues to outweigh the limited supply being brought to market in both the established and new supply markets.”

“Locally, retirees and those approaching retirement are still taking advantage of this supply gap in the market, achieving elevated prices for their family homes and downsizing to a low-maintenance property,” said Ciesielski.

Ciesielski said expats are returning home from working overseas and using their stronger purchasing power to buy real estate in Australia.

“The expat dollar is still favourable, and many are securing their ideal home for when returning to Australia,” she said.

Ciesielski said there is still strong interest from offshore for Australian real estate, helped by currency moves.

“Foreign interest in Australian prime residential property has remained relatively strong throughout 2016, with many currencies holding an ongoing purchasing power against the Australian dollar,” she said.

Auckland was a standout performer, with prime real estate prices climbing 16.0 per cent for the year. “A lack of supply, rising demand and record low interest rates fuelled price growth,” according to the report.

Randwick in Sydney was highlighted as a potential growth spot, as was Melbourne.

Ciesielski, said “Randwick’s heritage-listed homes are dotted around two hospitals, a university campus and the Royal Randwick Racecourse, while some of Sydney’s finest beaches are within walking distance. Commuting into the central business district will be made easier with the opening of several stations on a new light railway line, which is scheduled for completion in 2018. A renovated, modern house starts from A$2.3m, while contemporary, higher density projects currently in the pipeline look set to push the median price for an apartment significantly higher than the current A$850,000.”

The report said that, with Melbourne’s population forecast to surpass Sydney’s by 2036, the city’s property prices were likely to outperform. Melbourne’s title, granted by the Economist Intelligence Unit, as the “world’s most liveable city” also works in its favour.

Read the Knight Frank Wealth Report 2017 in full here.

SOURCE: The Real Estate Conversation

POSTED: March 1, 2017

AUTHOR: Staff Writer

@Luxury Estates – experts on visionary marketing of Australia’s most luxurious real estate for sale